Customer Stories

How 1NCE scaled global IoT billing with Lago

Finn Lobsien • 2 min read

Jul 30, 2025

/5 min read

For a SaaS company managing 10,000 customers on a multi-tiered subscription plan with usage-based add-ons, manual billing can result in revenue leakage of 2-5% annually. These losses stem from errors in proration calculations, unbilled usage, and delays in processing upgrades. AI-powered billing platforms are engineered to solve this by automating the entire revenue lifecycle, from invoice generation to payment collection and revenue recognition. By leveraging machine learning and API-driven workflows, these systems can significantly reduce billing errors, accelerate time-to-cash, and provide the financial infrastructure necessary for scalable growth[1].

Modern billing solutions designed for SaaS, such as Lago, are not merely invoicing tools; they are sophisticated systems that manage complex subscription logic, process payments intelligently, and deliver actionable financial analytics. This enables finance and RevOps teams to move from reactive, manual processes to proactive, data-driven revenue management.

An effective AI billing platform is built on a set of core architectural components that work in concert to automate and optimize financial operations. These components are designed to handle the complexity and scale inherent in modern SaaS business models.

The foundation of any billing system is its ability to generate accurate invoices. AI-powered platforms automate this by integrating directly with product usage databases and CRM systems via APIs. This allows for the automated application of complex pricing rules without manual intervention. For example, a system can be configured to handle:

This API-driven approach eliminates manual data entry, directly connecting invoice accuracy to faster time-to-cash and a significant reduction in customer billing disputes.

To maintain healthy cash flow, collecting payments efficiently is as critical as invoicing accurately. AI billing systems integrate with a global network of payment gateways (e.g., Stripe, Adyen, GoCardless) to process transactions securely. The "intelligent" aspect is most evident in automated dunning management, which actively works to reduce involuntary churn[1]. When a payment fails, the system can:

This automated process recovers revenue that would otherwise be lost and reduces the manual effort required to chase down late payments.

SaaS businesses thrive on customer upgrades, downgrades, and add-ons. AI billing platforms are architected to manage these mid-cycle changes seamlessly. When a customer upgrades from a "Pro" to an "Enterprise" plan, the system automatically calculates the prorated charge for the remainder of the billing period and adjusts the recurring amount for future cycles. This ensures that expansion revenue is recognized immediately, directly contributing to higher Net Revenue Retention (NRR). Platforms like Lago are built specifically to handle these event-driven billing scenarios, providing the flexibility needed to support customer growth.

AI billing systems use machine learning algorithms to proactively identify and prevent errors. These models analyze invoicing data in real-time, flagging anomalies that deviate from established patterns. For instance, an algorithm can detect a mismatch between the services provisioned in the contract (stored in the CRM) and the final invoice amount, flagging it for review before it reaches the customer. This capability drastically reduces the time finance teams spend on manual month-end reconciliation and prevents costly billing mistakes that can erode customer trust.

Beyond operational automation, AI billing platforms serve as a critical source of financial intelligence. By unifying billing, payment, and subscription data, they provide real-time dashboards and API endpoints for tracking key SaaS metrics:

Furthermore, these systems generate auditable data trails essential for compliance with revenue recognition standards like ASC 606 and IFRS 15, ensuring financial statements are accurate and defensible[1].

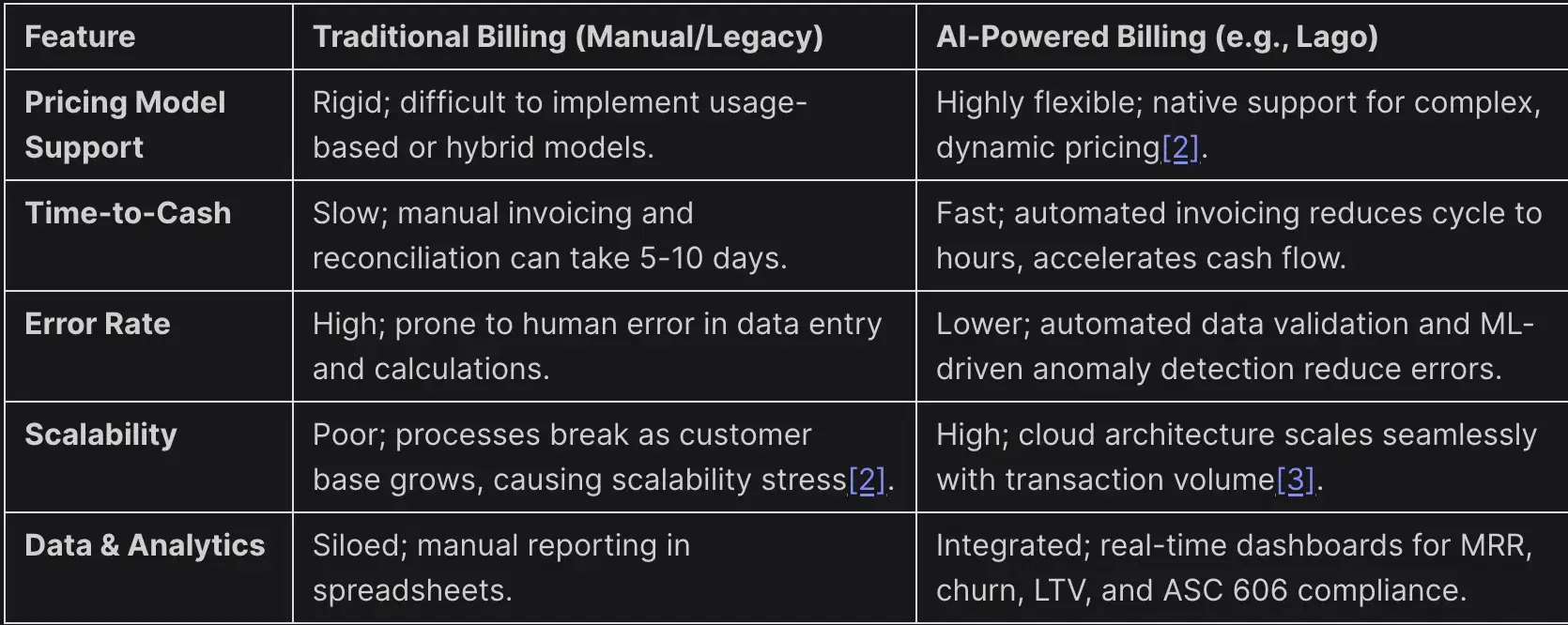

The architectural differences between modern AI-powered billing platforms and traditional or manual systems lead to starkly different business outcomes. For SaaS companies, choosing the right infrastructure is critical for scalability and financial health.

Deploying an AI billing system requires a strategic approach focused on integration, security, and scalability.

A billing platform cannot operate in a vacuum. Its value is maximized through deep, bidirectional integration with the existing tech stack. This is achieved via robust REST APIs that sync data with:

This creates a single source of truth for all revenue-related data, eliminating departmental silos[1].

Modern billing platforms are cloud-native solutions built with security and compliance at their core. Look for platforms that maintain SOC 2 Type II certification and are fully compliant with data privacy regulations like GDPR and CCPA. For global SaaS companies, the ability to manage regional tax rules and data residency requirements is a critical architectural feature that mitigates compliance risk[3].

The vast majority of modern billing solutions are delivered as a cloud service, offering superior scalability and reliability. A multi-tenant cloud architecture ensures that the system can handle transaction volume growth without performance degradation or the need for manual infrastructure management[3]. For organizations with unique data governance policies, a self-hosted option may be available as an alternative deployment model.

How does AI billing handle complex SaaS pricing models (e.g., usage-based, tiered)?

AI billing platforms handle complex models by ingesting event-based data via API. For example, a platform like Lago can track API calls, data storage, or active users in real-time. It then applies predefined rating and pricing rules to calculate charges automatically, accommodating tiers, overages, and prepaid credits without manual intervention.

What is the typical ROI for implementing an automated billing system in a mid-market SaaS company?

While ROI varies based on business complexity, companies often see returns within 6-12 months. Key drivers include a reduction in revenue leakage from billing errors, a significant reduction in time spent on manual billing tasks, and a reduction in involuntary churn due to automated dunning[1].

How does a modern billing platform ensure data integrity with a CRM like Salesforce?

Data integrity is ensured through bidirectional API integration. When a deal is marked "Closed-Won" in Salesforce, a webhook can trigger the automatic creation of a customer and subscription in the billing platform. Conversely, when an invoice is paid or a subscription is canceled, the billing system updates the corresponding account and opportunity records in Salesforce, ensuring both sales and finance teams operate from a consistent, real-time dataset.

What are the key considerations for migrating from a legacy billing system to an AI-powered one?

Key considerations include: 1) Data Migration: Planning the clean transfer of customer, subscription, and historical billing data. 2) Integration Mapping: Defining API endpoints and data flows between the new platform and existing systems (CRM, ERP). 3) Cutover Strategy: Deciding between a phased rollout (e.g., new customers only) or a full cutover, and planning for potential downtime. 4) Testing: Rigorously testing billing scenarios, prorations, and dunning cycles in a sandbox environment before going live.