Customer Stories

How 1NCE scaled global IoT billing with Lago

Finn Lobsien • 2 min read

Jul 29, 2025

/5 min read

Automating billing can significantly reduce invoice processing time and increase accuracy, directly impacting a SaaS company's ability to scale efficiently. For modern SaaS businesses, manual billing processes are a significant operational bottleneck, leading to revenue leakage, delayed cash flow, and a high cost of ownership. The transition to AI-powered billing automation is increasingly viewed as a strategic necessity. These platforms leverage machine learning to handle complex subscription logic, automate revenue recognition, and provide predictive financial insights, enabling businesses to accelerate time-to-cash and improve Net Revenue Retention (NRR).

This analysis provides an architectural and functional overview of the core benefits of AI billing automation and evaluates the leading platforms designed to meet the rigorous demands of SaaS operations.

Adopting an AI-driven billing architecture provides measurable improvements across revenue operations, financial forecasting, and scalability. Businesses that implement automated invoicing report increased revenue collection efficiency, a critical metric for any subscription-based model.

AI billing platforms automate the entire quote-to-cash lifecycle, from invoice generation and dunning management to payment processing and account reconciliation. By eliminating manual data entry and spreadsheet-based calculations, these systems drastically reduce the incidence of billing errors, which are a primary cause of customer churn and revenue loss. This automation ensures that complex billing events, such as prorations and mid-cycle upgrades, are calculated with precision, securing revenue and maintaining customer trust.

Modern SaaS companies require billing systems that can support a wide array of pricing strategies without requiring extensive engineering work. AI-powered platforms are architected to handle complex models, including:

This flexibility allows product and finance teams to experiment with pricing strategies, monetize new features, and implement upselling opportunities to drive expansion revenue.

Effective cash flow management is supported by AI's ability to analyze historical payment data and forecast future behavior. Advanced systems can predict payment delays and identify at-risk accounts, allowing for proactive intervention.

Key features include:

These capabilities provide finance leaders with real-time visibility into cash flow and support more accurate financial forecasting.

Cloud-native AI billing solutions provide robust security and compliance as a core component of their service. AI algorithms enhance fraud detection by identifying and flagging anomalous transaction patterns in real-time, protecting both the business and its customers. Leading platforms are typically compliant with standards such as SOC 2, GDPR, and PCI DSS, offloading a significant compliance burden from the SaaS business.

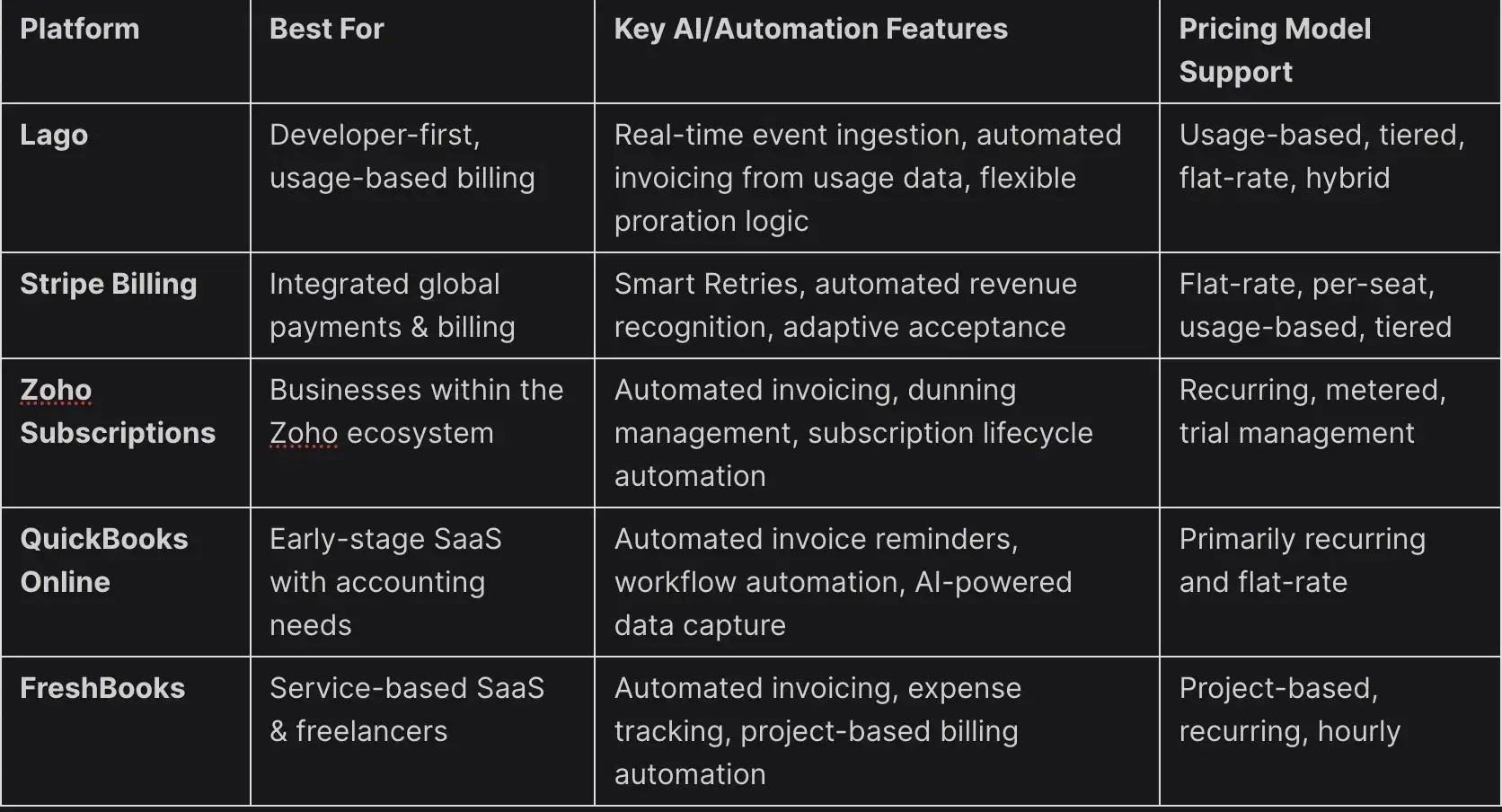

Selecting a billing platform requires evaluating its architecture, feature set, and ability to scale with your business. The following platforms are recognized for their strong capabilities in automating billing for SaaS companies.

Lago is an open-source, developer-centric billing platform designed for complex, usage-based pricing models. Its API-first architecture provides engineers with the flexibility to integrate billing logic directly into their products.

Stripe is a dominant force in online payments, and its billing platform is a comprehensive solution for SaaS companies requiring a unified system for payments and subscriptions.

For businesses already invested in the Zoho ecosystem, Zoho Subscriptions offers a tightly integrated solution for managing the entire customer lifecycle.

QuickBooks is a leader in small business accounting, and its online platform includes features for automating recurring billing, making it a viable option for early-stage SaaS companies with simple pricing models.

FreshBooks is known for its user-friendly interface and is particularly well-suited for service-based SaaS companies, consultants, and freelancers who bill for projects or time.

Integrating a new billing system is a critical engineering project that requires careful planning.

The selection of an AI billing automation platform is a strategic decision that directly influences a SaaS company's operational efficiency, financial health, and ability to scale. For businesses with complex, usage-based pricing, a developer-first, API-driven solution like Lago offers flexibility and control. For those seeking an all-in-one solution with integrated payments, Stripe remains a powerful choice. Ultimately, the best platform is one that aligns with your specific pricing model, technical resources, and long-term growth trajectory. Investing in the right architecture is fundamental to building a resilient and scalable revenue infrastructure.