Oct 16, 2024

/6 min read

How open can Stripe be?

In 2014, tasked with replacing a payment stack at a Paris-based startup, I found it surprisingly hard to evaluate payment processors due to unclear info and technical challenges. We eventually chose Stripe, even though it was brand new in Europe, thanks to its clear pricing, easy developer adoption, and straightforward documentation. Despite initial skepticism, Stripe is now a highly respected brand in tech and beyond. The key question now is how much of the financial stack Stripe will dominate going forward. Here’s a brief look at the key ingredients behind an outlier’s success.

Why Stripe Won

Disclaimer

I’m not a fan of “overnight success stories” because they overlook the hard work, resilience, and persistence involved. Stripe worked tirelessly to build a complete product, overcome trust issues, and navigate regulations—especially challenging when handling money flows.

Stripe picked the right “wave”

Stripe was founded in 2010 and definitely rode the e-commerce wave. The same year that Cyber Monday Sales in the US surpassed $1 billion. To give another example, in 2000, only 22% of Americans used a computer or phone to buy something online, whereas 80% of them did it in 2017. Stripe was picked by Shopify, and it definitely grew with the winners they were picking as customers. Although it seems to be obvious in hindsight (like all things in entrepreneurship), picking the right wave (powerful enough) at the right moment (before it becomes obvious), and matching its speed by paddling hard enough (ok I’ll stop the surf metaphors here) is a skill.

Stripe had an incredibly good taste

Stripe prioritized a group often overlooked in the payments industry: developers. Traditionally, payment processors were selected by finance teams, focusing on pricing, regulations, and coverage. Developers' input was rarely considered, even though a payment solution that wasn’t developer-friendly could lead to significant technical and business issues. Only experienced leaders understood that involving developers in the decision-making process was crucial to avoid long-term technical debt.

Stripe fully committed to the developer community, prioritizing the developer experience with strong conviction. While its documentation is highly praised, the true breakthrough was that developers could implement a payment system over a weekend, allowing businesses to start earning revenue quickly. This was a stark contrast to the traditional banking process, which involved multiple calls, extensive paperwork, and outdated technical documentation.

Stripe diversified the product offering early on, and Stripe Connect was a hit

Beyond expanding into Europe and Canada in 2013, Stripe also ventured into adjacent markets. They launched Stripe Atlas in 2015, helping global entrepreneurs set up U.S. businesses, and Stripe Radar, a fraud prevention tool. However, the standout product is Stripe Connect, which enables businesses to create their own payment platforms with minimal regulatory effort, effectively turning many into vertical SaaS providers. While payments are often commoditized, Stripe Connect's ease of use remains unmatched in the market.

Stripe showed extreme resiliency in 2022 and is now “gushing with cash”

According to The Information, Stripe reported around $615 million in free cash flow for the quarter ending in June, a major improvement from its $500 million cash burn in 2022. This figure exceeded the free cash flow of its rival Adyen for the first half of 2023. Stripe’s non-payments business, particularly billing software, has seen significant growth, with clients such as OpenAI, Atlassian, and Notion. The company expects its billing and tax software division to soon reach an annual revenue run rate of $500 million. Gartner recently recognized Stripe as a top provider in this space.

Stripe continues to switch gears and is eyeing software margins

At the Stripe Session in April 2024, several major updates were announced, with a strong focus on using AI to enhance payment systems and improve user experience. Some key announcements include:

- AI-powered tools: Stripe introduced AI-driven upgrades like the "Optimized Checkout Suite," which personalizes payment methods for users, and new fraud prevention features through "Radar Assistant." This allows businesses to use AI to reduce fraud while minimizing false positives.

- Modular Services: Stripe is opening up: Stripe made its core products—such as the Optimized Checkout Suite and Stripe Billing—available to companies using other payment providers. This modular approach provides flexibility for businesses looking to integrate specific Stripe features without overhauling their payment systems.

- Revenue automation: Stripe also enhanced its revenue management tools, including the ability to support more B2B pricing models, in addition to the B2C and pure subscription models it catered to so far.

How far can Stripe go?

Stripe is expanding its focus from payments to financial software. It’s easy to envision Stripe becoming a leader in financial software, with payments evolving into more of a “loss leader” to drive adoption of other products. However, this raises some key questions:

Can Stripe’s software products stand on their own?

Would companies use them even if they don’t rely on Stripe Payments?

Recently, Stripe has focused heavily on billing, with major public announcements at Sessions, billboards in the Bay Area, and white papers. Stripe’s RFA products are projected to generate over $500 million in revenue. This rapid growth is clear, but a critical question remains: Despite their efforts, Stripe’s billing product is still playing catch-up with more specialized B2B billing solutions (example 1, example 2, example 3). Shifting from a product rooted in B2C and subscription models to one that serves B2B use cases is a significant transition that takes time. Stripe has moved quickly given its size, but competing priorities—unlike vertical specialists focused solely on billing, tax, or fraud—slow progress.

Stripe also entered the tax software space, launching Stripe Tax and acquiring TaxJar in 2021. TaxJar was meant to become a key part of Stripe’s revenue platform, but the two products are still marketed separately, with Stripe Tax positioned as “working better with Stripe Payments.” Meanwhile, specialized players like Avalara, Anrok, and Fonoa have continued to thrive, offering solutions compatible with multiple payment processors, including Stripe. This highlights the market opportunities that remain open, even after Stripe’s acquisition of TaxJar.

Pricing Structure: A Double-Edged Sword

Stripe is known for pricing its products with a percentage-based cut on revenue, including for software offerings. This strategy hasn’t seen significant changes, likely because it works for both Stripe and its customers. Modifying it could disrupt Stripe’s installed user base and negatively affect financial metrics—something the company would want to avoid ahead of an IPO.

How Open Can Stripe Be?

A recent focus for Stripe has been “extended interoperability”—allowing products like Stripe Billing and Stripe Radar to work with non-Stripe transactions. However, questions arise:

- How far will Stripe go with interoperability?

- Will they connect with processors requested by users, even if those processors are direct competitors?

- Can Stripe balance openness with maintaining the value of its ecosystem without cannibalizing revenue?

Stripe’s success is built on a closed ecosystem of interconnected products centered around payments. Even exporting Data outside the Stripe Ecosystem is a pain, except if you use "Stripe Data" products, more here. While these products work seamlessly within the Stripe environment, exporting data out of Stripe can be challenging. This raises concerns about how transparent and open they can be, especially when their users’ interests conflict with their own.

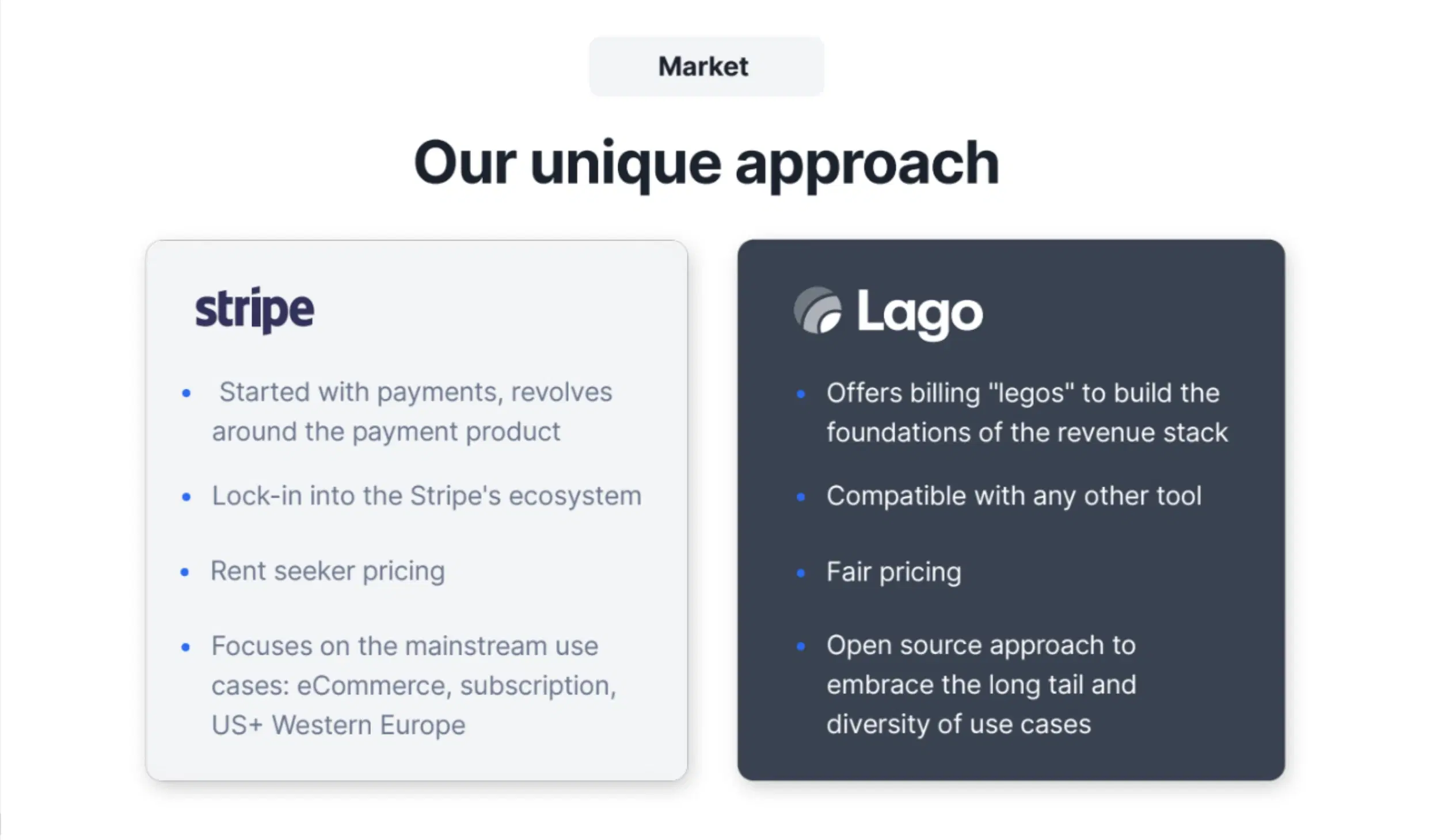

Here’s a slide from our Series A deck. While I’m an ex-McKinsey consultant (and not a fan of building slides, building companies is much more fun :) ), the design is simple because we weren’t actively fundraising at the time (full deck here).

We believe Stripe succeeded with its closed ecosystem strategy—a model that comes with trade-offs but undoubtedly fueled its growth. That said, we also see demand for an open and transparent approach:

- Transparency and openness: Open-source and user-centric.

- Interoperability from day one: Lago is tool-agnostic, allowing anyone to build connectors and prioritizing native integrations based on user requests.

- Financial software-first: Users own and control their data, with the option to self-host instead of paying for Stripe Data Pipeline .

Is it bold, maybe even a bit crazy, to think alternatives to Stripe can succeed? Probably. But that’s the essence of entrepreneurship!