Billing

Self-Hosted vs. Cloud Billing: Data Sovereignty for Regulated Industries

Finn Lobsien • 9 min read

Jun 18, 2025

/6 min read

The shift to usage-based pricing is reshaping how SaaS and AI companies monetize their products. According to OpenView, nearly 39% of SaaS companies now price primarily on usage, a sharp increase from a decade ago. This trend is driven by the rise of AI APIs, cloud infrastructure, and the need for flexible, scalable billing models that align with real customer value. For technical teams, the challenge is not just in setting the right price, but in building a billing system that can meter, invoice, and report on usage at scale—without slowing down product development or introducing errors.

Definition and Core Principles

The pay-as-you-go (PAYG) pricing model charges customers based on actual consumption rather than a fixed subscription fee. Instead of paying a flat rate, users are billed for the specific resources or features they use—such as API calls, compute time, storage, or even the number of AI tokens processed[1]. This approach is also known as usage-based or consumption-based pricing.

How It Works

Example: A cloud storage provider charges per gigabyte stored and per API request, so a customer’s bill reflects their actual usage each month.

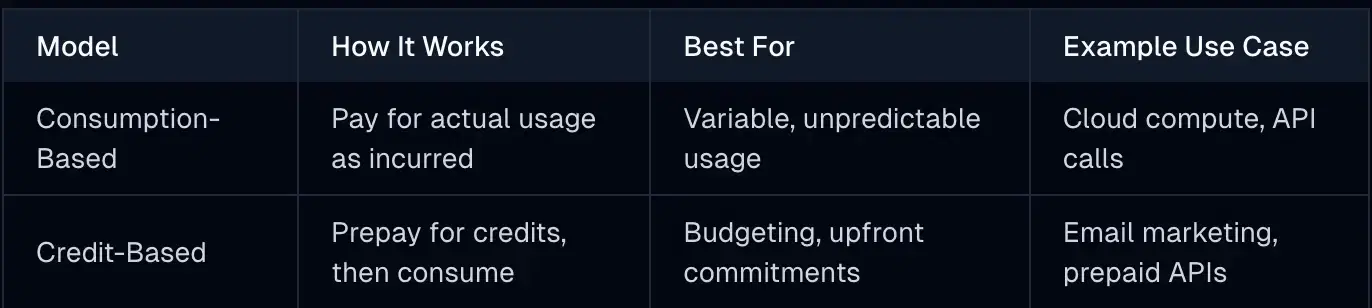

Consumption-Based vs. Credit-Based

There are two main PAYG structures in SaaS:

Customers pay for what they use, as they use it. This is common in cloud infrastructure (e.g., AWS EC2 charges by the second for compute resources) and payment processing (e.g., a percentage per transaction)[2].

Customers pre-purchase credits, which are then redeemed for services. This model provides upfront cash flow for the business but can introduce breakage if customers don’t use all their credits.

Consumption-Based vs. Credit-Based

There are two main PAYG structures in SaaS:

Customers pay for what they use, as they use it. This is common in cloud infrastructure (e.g., AWS EC2 charges by the second for compute resources) and payment processing (e.g., a percentage per transaction)[2].

Customers pre-purchase credits, which are then redeemed for services. This model provides upfront cash flow for the business but can introduce breakage if customers don’t use all their credits.

ModelHow It WorksBest ForExample Use CaseConsumption-BasedPay for actual usage as incurredVariable, unpredictable usageCloud compute, API callsCredit-BasedPrepay for credits, then consumeBudgeting, upfront commitmentsEmail marketing, prepaid APIs

1. Lower Upfront Costs and Faster Adoption

PAYG reduces the barrier to entry. Customers can start small, pay only for what they use, and scale up as their needs grow. This flexibility is especially attractive for businesses with fluctuating or unpredictable workloads[2].

2. Revenue Scales with Customer Growth

As customers use more resources, their spend increases. This aligns vendor revenue with customer value and supports higher net revenue retention (NRR). Industry data shows that companies with usage-based pricing models see year-over-year revenue growth of 29.9%, compared to the SaaS average of 21.7%.

3. Deep Customer Insights

Metering usage at a granular level provides valuable data on how and when customers use your product. This informs product development, pricing optimization, and customer success strategies.

4. Fairness and Flexibility

Customers appreciate not paying for unused capacity. PAYG models are perceived as fair, which can improve satisfaction and reduce friction in the sales process[3].

Callout: For AI and API-first companies, PAYG is often the only viable way to monetize high-cost, variable workloads without overcharging low-usage customers or undercharging power users.

1. Revenue Predictability

Unlike flat-rate or tiered models, PAYG introduces revenue volatility. Forecasting becomes more complex, especially when large customers ramp usage suddenly or unpredictably.

2. Customer Retention

Without a subscription commitment, customers can reduce or stop usage at any time. This can increase churn, though it also means customers are less likely to cancel outright if their needs temporarily decrease.

3. Implementation Complexity

Accurate metering, billing, and reporting require robust infrastructure. Tracking usage in real time, handling edge cases, and ensuring audit-ready invoicing are non-trivial engineering challenges—especially at scale.

Insight: Many SaaS teams underestimate the technical debt of building and maintaining a custom usage-based billing system. Delays, errors, and compliance risks can quickly erode the benefits of PAYG.

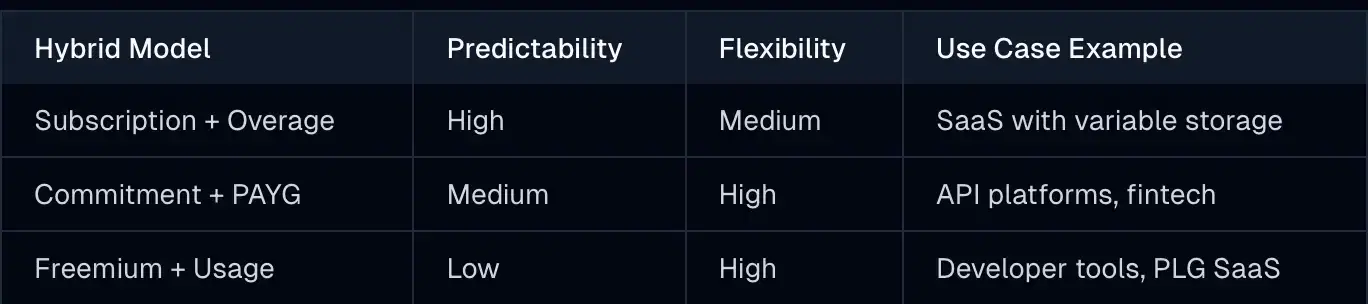

What Is Hybrid Pricing?

Hybrid pricing blends PAYG with other models, such as subscriptions or minimum commitments. This approach offers predictable baseline revenue while allowing customers to scale usage as needed.

Example: An AI platform offers 1 million tokens per month in its subscription, with additional tokens billed at a per-unit rate.

1. Choose the Right Metric

Identify the resource that best reflects customer value—tokens, API calls, compute hours, storage, or seats. For AI and infrastructure, this often means tracking events at millisecond granularity.

2. Build or Adopt Real-Time Metering

Accurate, real-time metering is essential. Systems must ingest and process thousands of events per second, apply pricing rules, and aggregate usage for billing and analytics.

3. Automate Invoicing and Collections

Automated invoice generation, multi-currency support, tax compliance (e.g., EU VAT, US sales tax), and dunning are critical for scaling globally and reducing manual errors.

4. Provide Usage Transparency

Customers expect to see real-time usage and cost data. Embedded customer portals and API access to usage metrics improve trust and reduce support tickets.

5. Analytics and Reporting

Finance and product teams need dashboards for MRR, gross revenue, invoice collection, and usage trends. This data supports pricing optimization and strategic planning.

Technical Specification Example:

{

"event": "api_call",

"timestamp": "2025-06-17T22:45:54Z",

"customer_id": "12345",

"usage": 1,

"resource": "ai_token"

}

This event-driven architecture enables millisecond-level metering and supports complex pricing logic.

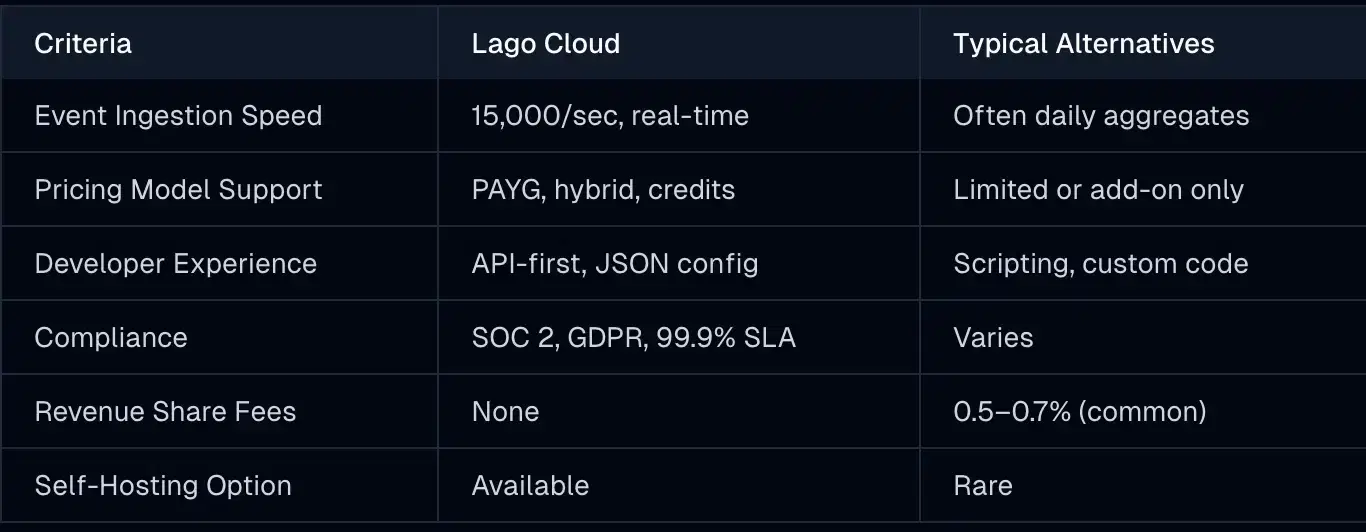

Lago provides a developer-friendly, API-first billing platform purpose-built for complex usage-based and hybrid pricing models. Key differentiators include:

For mid-market and enterprise SaaS companies shifting to usage or hybrid pricing, Lago accelerates go-live timelines (weeks, not quarters) and reduces engineering overhead, while providing finance-grade governance and analytics.

Pay-as-you-go pricing is now a core strategy for SaaS and AI businesses that need to align revenue with customer value, support rapid scaling, and offer flexible, fair pricing. While the model introduces technical and operational complexity, the right billing infrastructure—like Lago—enables real-time metering, hybrid pricing, and global compliance without slowing down product teams. As usage-based monetization becomes the norm, investing in robust, developer-friendly billing systems is key to staying competitive and maximizing growth[2].

Ready to modernize your billing? Explore how Lago can help you implement usage-based and hybrid pricing models with speed, accuracy, and control.

Content