Customer Stories

How 1NCE scaled global IoT billing with Lago

Finn Lobsien • 2 min read

Nov 1, 2024

/8 min read

Recurly is a well-known subscription management software and recurring billing solution, offering a comprehensive platform with a mix of advanced subscription capabilities and a highly intuitive interface. Recurly was designed to help businesses increase their recurring revenue by focusing on pricing plans, subscription management, revenue recognition, and more

While it's a solid choice for businesses looking to simplify subscription billing and scale recurring revenue, it does come with a few downsides, mainly its limitations in handling advanced functionalities like usage-based billing and complex pricing models.

Features such as progressive billing, hybrid pricing, and dynamic pricing are either lacking or not fully optimized, which can be a barrier for businesses with more intricate billing needs. If you're looking for a new alternative to unlock use cases like usage-based billing or metering, here are some tools you should consider to migrate from Recurly:

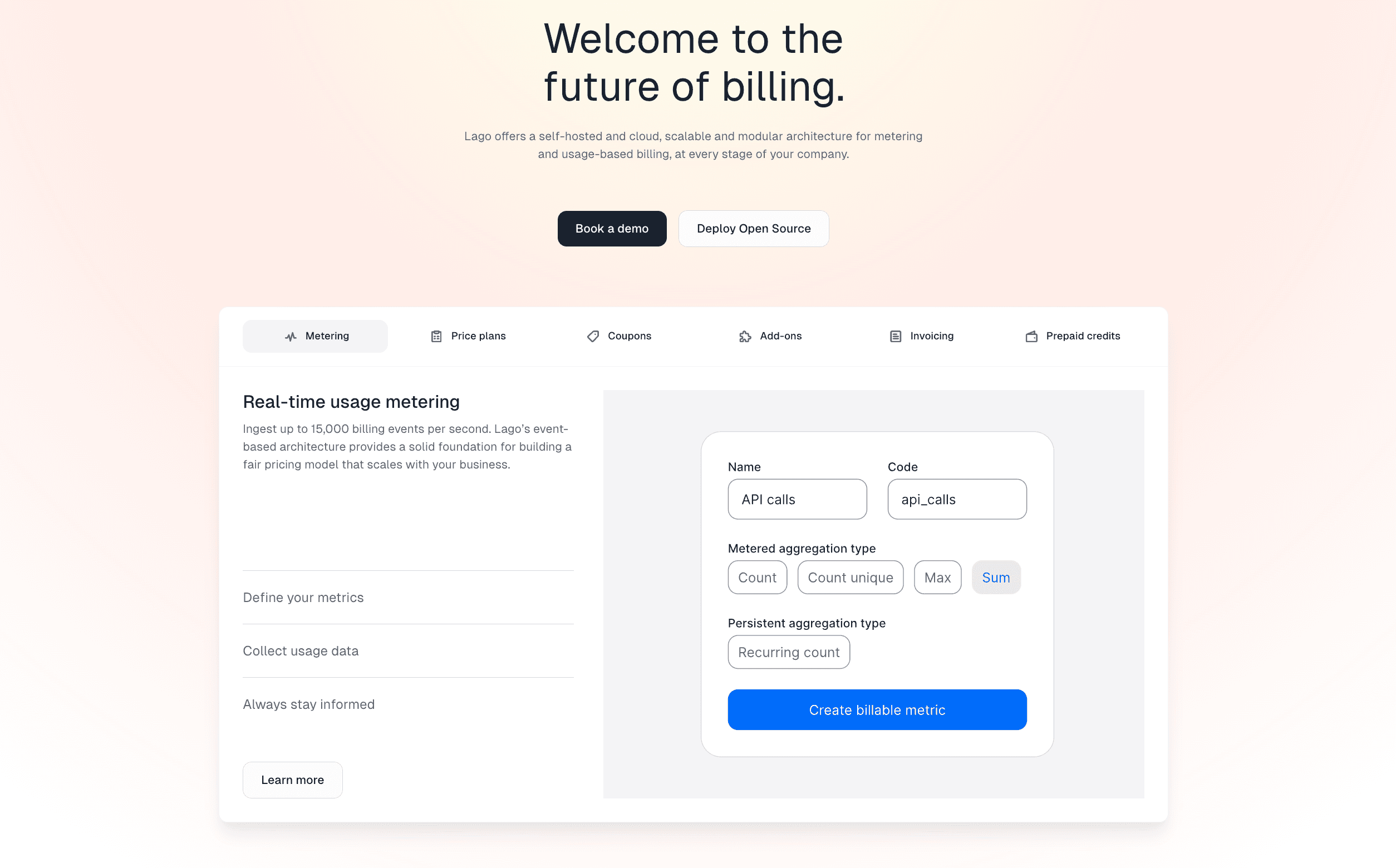

Lago (that’s us!) is an open-source billing infrastructure tailored for businesses with complex, customizable billing needs. With Lago, companies can set up postpaid, prepaid credits, and progressive billing options.

Lago’s agnostic approach to payment processors and billing-adjacent applications means it integrates seamlessly with tools like Stripe, NetSuite, Salesforce, and Anrok, making it highly adaptable for various tech stacks.

Lago is ideal for SaaS companies and businesses with complex billing requirements, looking for a developer-first solution, with maximum control and flexibility.

Lago offers a free forever open-source product. Their premium offering consists of a platform fee, and consumptions based on the volume of events ingested. Lago doesn’t take a cut on revenue.

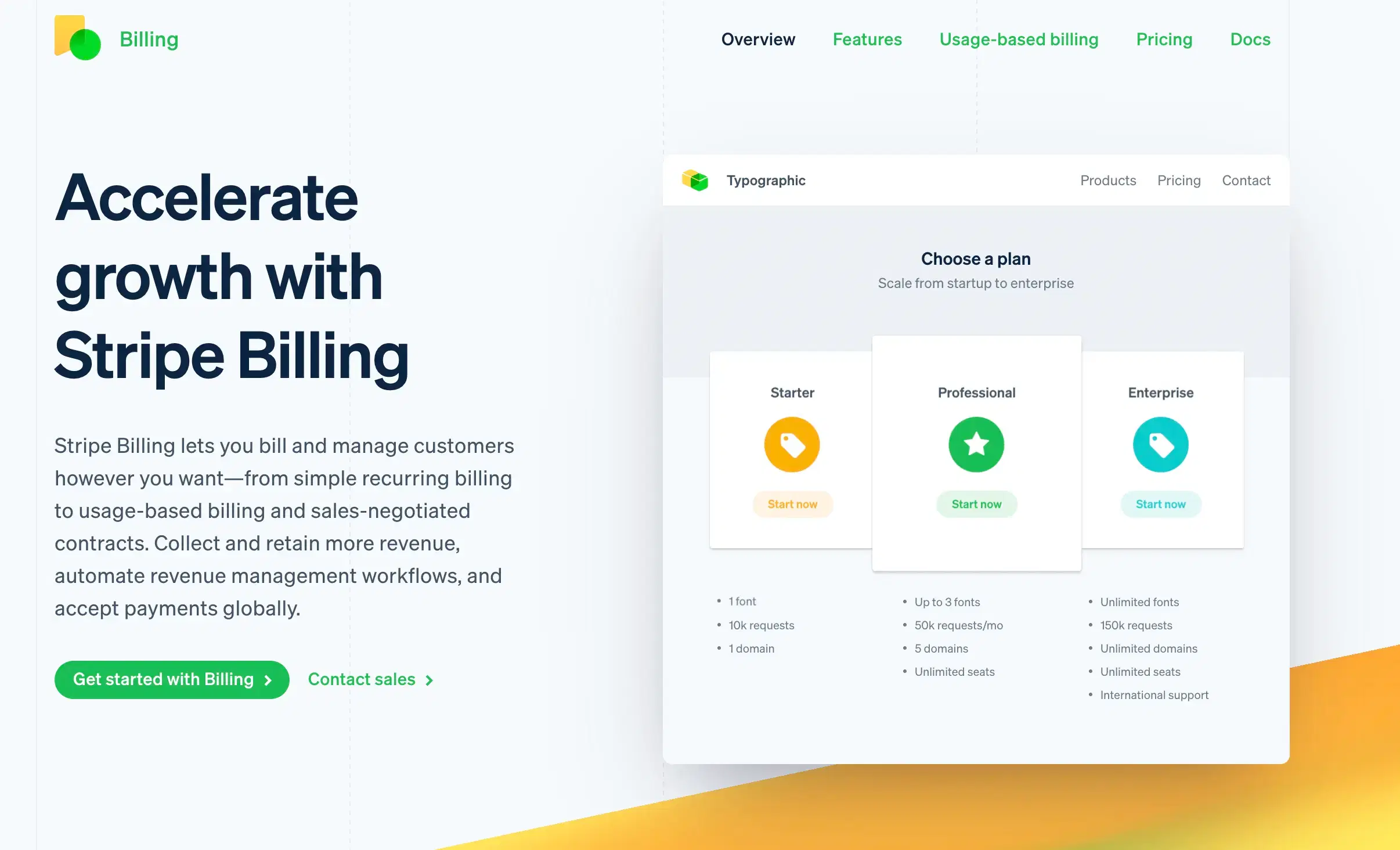

Stripe Billing is part of Stripe’s ecosystem, offering a straightforward billing solution with native payment processing integration. While it may lack some of the advanced features found in dedicated billing platforms, it’s a practical choice for businesses already using Stripe for payments.

Stripe Billing is best suited for small to mid-sized companies that use Stripe for payments and need subscription features.

Stripe Billing fees start at 0.7% of the transaction volume (i.e., they take a cut on revenue). Here’s our Stripe Calculator, for more details.

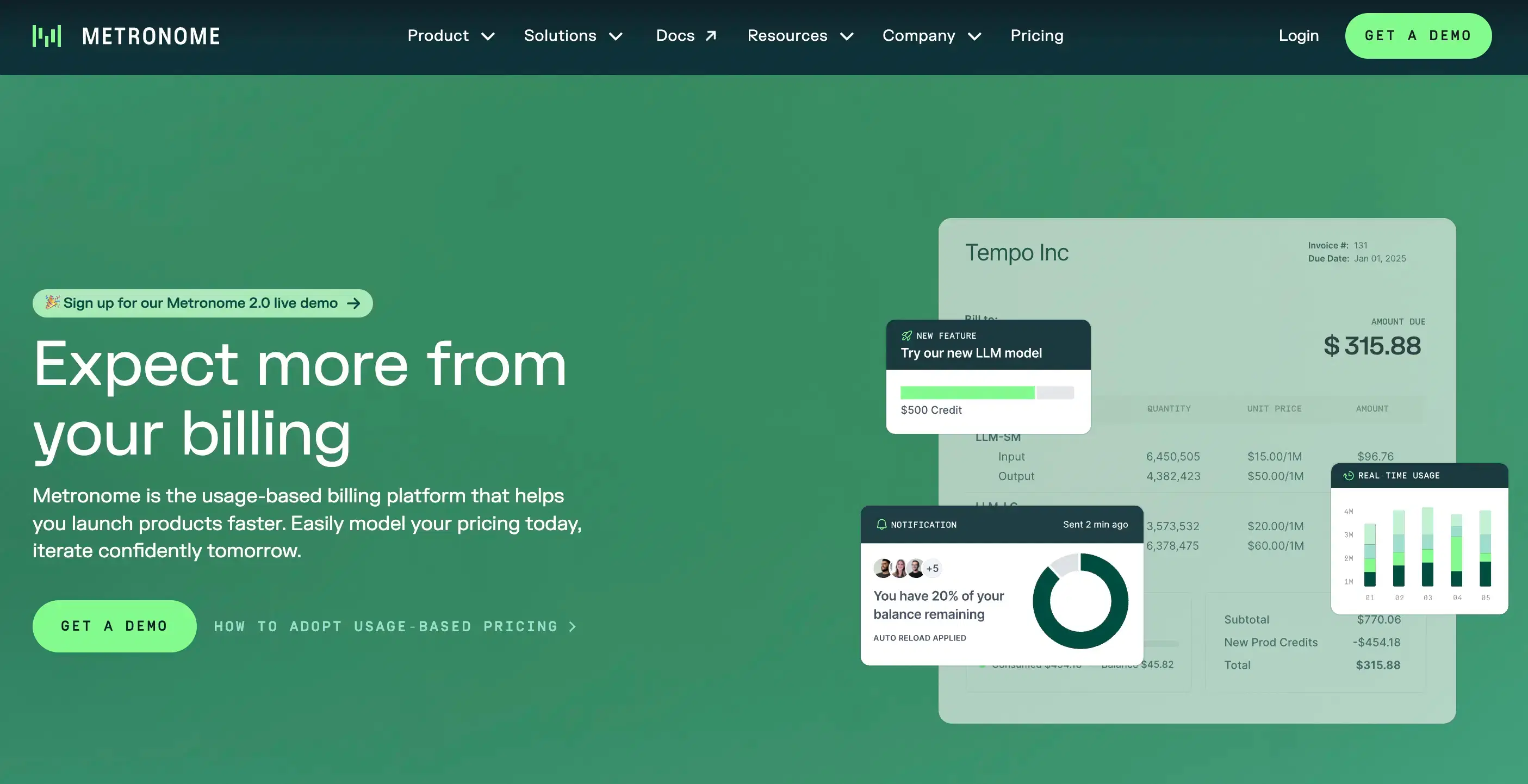

Metronome is a key player in the usage-based billing and metering landscape, offering an easy-to-implement solution for business operators that requires minimal engineering resources. While it may lack some of the advanced capabilities and engineering flexibility found in other dedicated billing platforms, it remains a practical choice for businesses seeking a straightforward, low-code or no-code approach to billing.

Metronome Billing is best suited for small to mid-sized businesses looking for an easy-to-implement, no-code solution to handle basic usage-based billing and subscription needs.

Metronome’s platform fees start at a $10K minimum annual fee for small businesses. Enterprise plans come with custom pricing. There is no free trial available. For more details, consult Metronome’s pricing page.

Zoho Subscriptions is part of the broader Zoho ecosystem, providing a straightforward subscription management solution with integrations across other Zoho products. It’s ideal for smaller companies that benefit from the suite’s interconnected applications.

Zoho Subscriptions is ideal for small businesses or those already using Zoho applications, offering essential subscription management with simple cross-platform integration.

Zoho Subscriptions starts at $49/month for basic plans, with tiered pricing based on additional features.

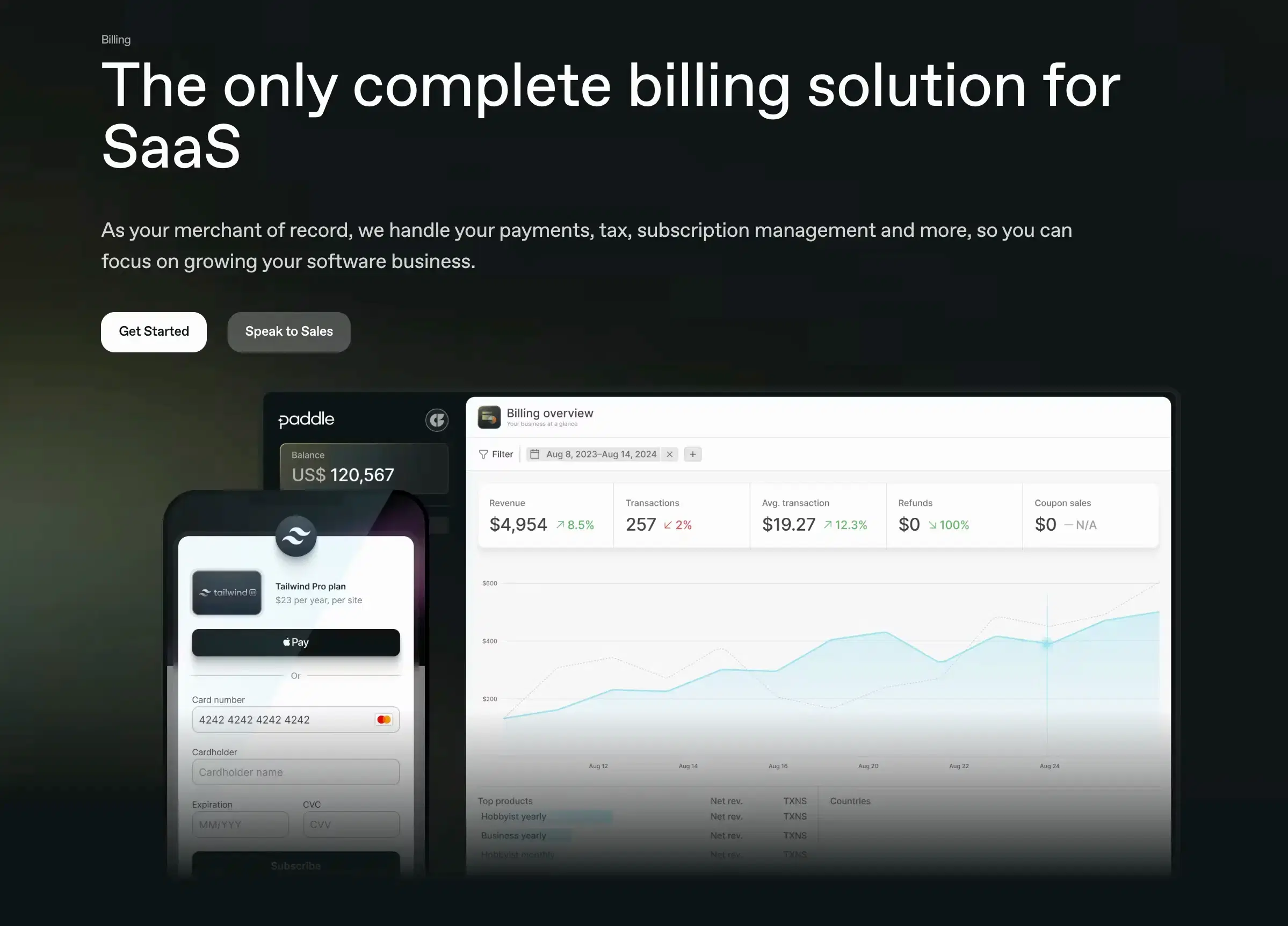

Paddle is a full-service billing platform that handles not only billing but also payment processing and tax compliance. Its built-in tax compliance and fraud prevention tools make it particularly useful for SaaS companies with global operations.

Paddle is ideal for SaaS companies needing a unified billing solution with integrated tax compliance for global customers. Paddle is also a Merchant of Record.

Paddle’s fee structure includes a percentage-based fee on each transaction, which varies based on volume and other factors. Their blended fee average between 5-7% of revenue.

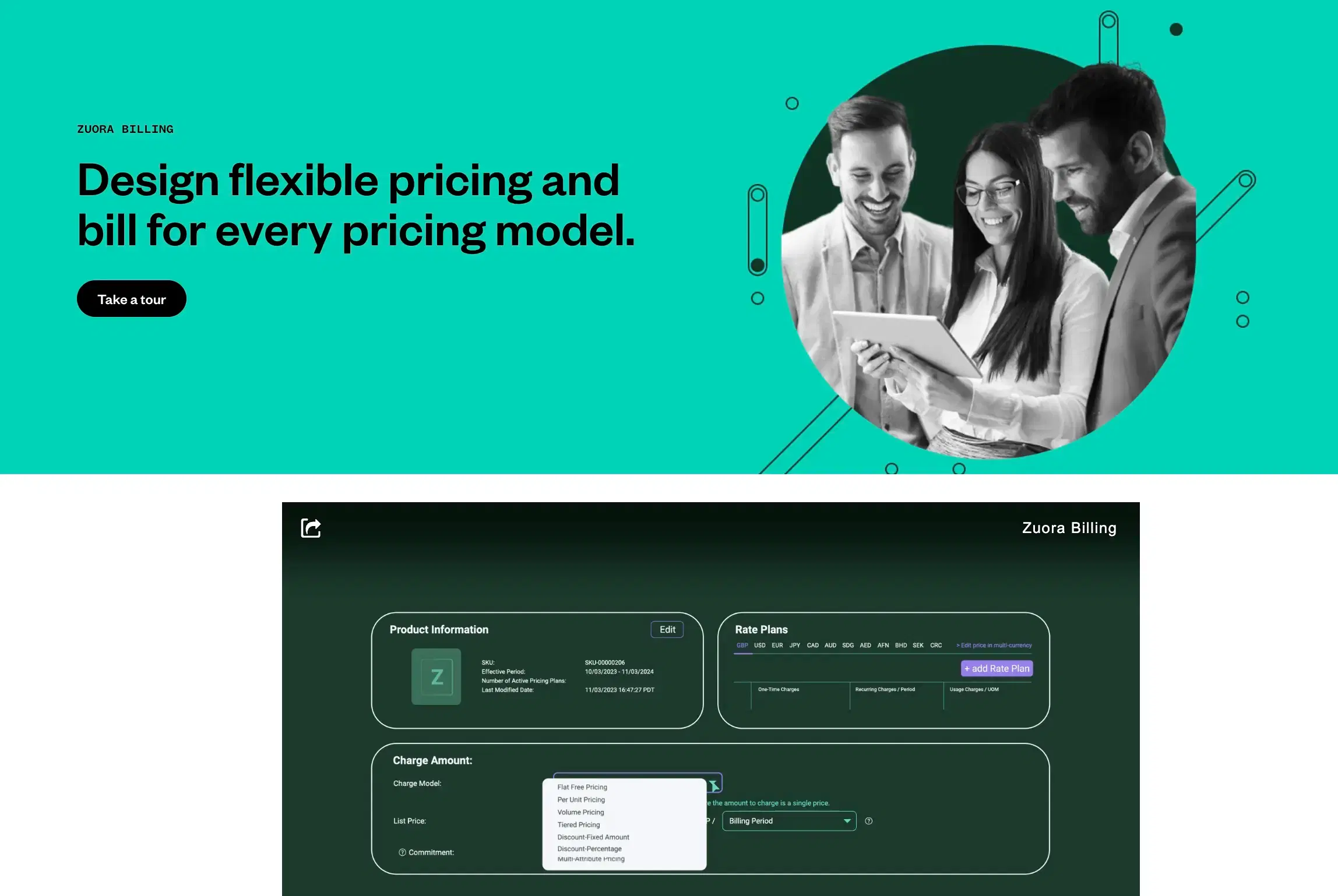

Zuora is an enterprise-level billing platform that handles complex subscription management, making it a popular choice for companies with advanced billing workflows. With seamless ERP and CRM integration, Zuora supports large businesses transitioning to subscription-based models.

Zuora is best suited for enterprises with sophisticated billing needs, especially those requiring ERP and CRM integrations.

Custom pricing, typically suited for mid-to-large enterprises with budget flexibility for enterprise-level features.

Some companies choose to build a custom billing system for complete control. While a homegrown solution allows for full customization, it comes with notable downsides, including high development costs, ongoing maintenance, and scalability challenges.

A homegrown billing system may be suitable for companies with unique billing requirements and the resources to support long-term development and maintenance.

Development costs vary significantly, often running into the tens of thousands for initial setup, plus ongoing maintenance expenses. The “cost of opportunity” of staffing engineering talent on a “non core” competency such as billing is also to be taken into account.

Before building billing yourself, we’d encourage you to have a look at the hundreds of comments on billing nightmares that our post attracted on HackerNews (this is how Lago was born!).

Original article here

HackerNews thread here

If your business needs go beyond simple subscriptions, and you’re seeking a billing solution that offers flexibility, scalability, and transparency, Lago might be the perfect alternative to Chargebee. Here’s an example of how Lago compares with Chargebee for a Banking as a Service company.

As an open-source, integration-agnostic platform, Lago provides maximum control and adaptability, making it easy to integrate with any payment processor, CRM, ERP, or tax compliance tool of your choice.

Lago’s extensive support for advanced billing models—such as postpaid, prepaid credits, and progressive billing—ensures that your billing infrastructure can evolve alongside your business.

With Lago, you gain a powerful, customizable billing solution that empowers your team to manage and scale with confidence.

Next generation companies, such as Mistral, Groq and Together.ai chose Lago. Learn more here.