Comparison: Stripe Billing vs Chargebee

What is Stripe Billing?

Stripe Billing is one of Stripe’s 21 products (more on that here). It is “recurring billing and subscription management software”, as defined on Stripe's website. It also offers limited usage-based capabilities, such as tiered or package pricing. Stripe Billing is directly connected to Stripe Payments to process payments for created invoices.

.avif)

What is Chargebee?

Chargebee, founded in 2010, is a recurring billing and subscription management platform that helps businesses automate and streamline their subscription operations. In 2021 and 2022, Chargebee acquired several new products (RevRec, Receivables, Retention) and evolved into a Revenue Growth Management (RGM) platform for subscription businesses. It now provides two services, including Billing and Retention.

.avif)

Stripe Billing vs Chargebee: Feature comparison

Subscription billing

Stripe Billing and Chargebee provide flexible subscription billing options, including fixed fees, tiered pricing, volume-based billing, along with dunning management and refund support. Businesses can set up recurring billing cycles, manage billing exceptions, and handle proration and discounts all within their platform.

Usage-based billing

Stripe Billing and Chargebee are not designed for usage-based billing. Both software packages are not event-based, so you need to convert usage-based events into billing units before sending data to Stripe Billing or Chargebee. These platforms do not provide flexibility for complex usage-based billing scenarios. For instance, there's no native "persistent metric", or a way to implement annual plans with monthly usage-based overages.

Rate limit

Stripe Billing's rate limit for usage ingestion is 100 requests per second, which can be a hard limitation for Cloud, API, Fintech, or AI companies (and lots of other verticals) that are processing high volume of events.

Chargebee has a rate limit of 150 requests per minute, which could prevent you from sending granular usage when you start scaling your business.

Invoicing

Stripe Billing does not include invoicing in its standard feature set. You need to pay additional fees to use Stripe’s invoicing system.

Chargebee offers advanced features for invoicing operations, including common fields, custom fields and payment instructions.

Taxation

Stripe Billing does not include taxation in its standard feature set. You need to pay additional fees to use Stripe Tax.

Chargebee includes a built-in taxation feature that allows you to calculate and apply taxes to your invoices. The taxation feature supports a wide range of tax types, including VAT, GST, and sales tax.

Payment gateways

Selecting Stripe Billing means you are exclusively tied to a single payment processor: Stripe Payments. You will not be able to use other processors to collect payments for the invoices your companies will issue. While Stripe is a widely-used payment processor, it may not support every product and may not be available in all countries. Notably, in countries such as India, Stripe Payments is not widely adopted.

Chargebee supports over 20 payment gateways, including Stripe Payments, across 50+ countries (details here).

Stripe Billing vs Chargebee: Pricing

Stripe Billing will cost you 0.5% (and up to 0.8%) of your transaction volume, on top of Stripe Payments (starts at 2.9% + $0.30 per successful card charge). With Stripe’s vendor lock-in, you might stack dozens of fees that will directly impact your revenue. Once again, Stripe has 21 products and each of them has its own pricing.

Chargebee offers two services, including Billing and Retention, with separate fees.For Billing, Chargebee offers:

- Starter plan: No flat fee, with the first $250K of cumulative billing included; 0.75% on billing thereafter. This plan includes basic billing features;

- Performance plan: $599 monthly flat fee for up to $100K of monthly billing; 0.75% on billing thereafter. This plan offers access to some advanced features; and

- Enterprise plan: Custom pricing.

Which solution is the best for you?

Stripe primarily focuses on Payment processing, with additional services for billing, invoicing and taxation incurring separate costs alongside Stripe Payments’s fee. Chargebee offers a more comprehensive billing solution that encompasses a wider range of billing-related features and capabilities. Stripe Billing and Chargebee cater to subscription and recurring billing. However, these software packages may not be flexible enough for handling complex pricing models and usage-based billing. In such instances, it's worth exploring alternatives that better accommodate intricate billing scenarios.

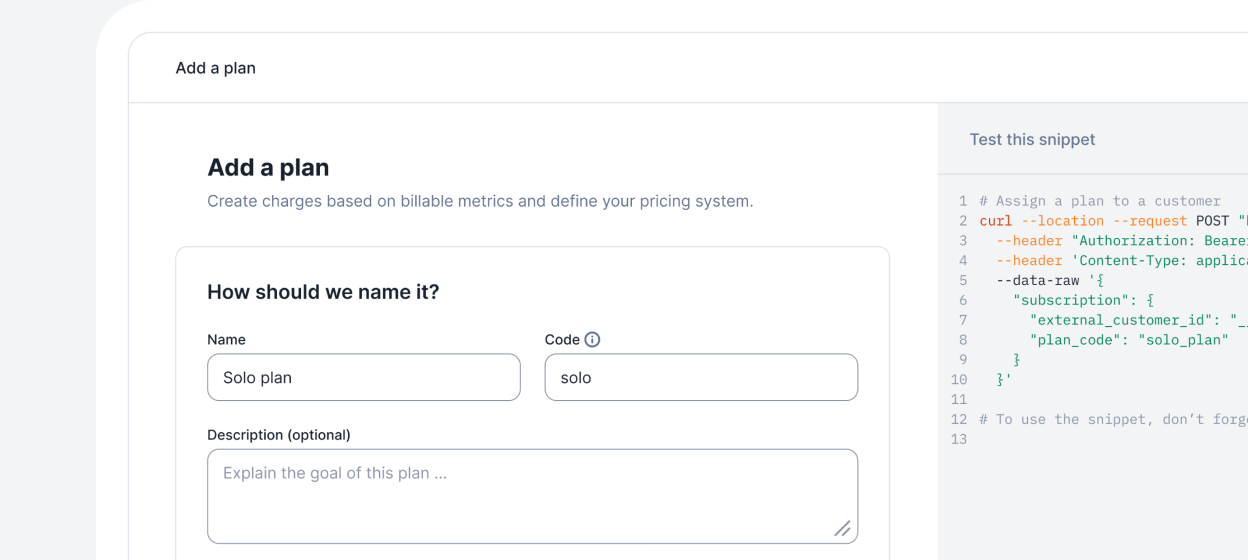

Lago, the Stripe Billing and Chargebee alternative

Lago is an open-source metering and usage-based billing solution. It offers a self-hosted and cloud-based, scalable, and modular architecture to manage subscriptions, usage-based billing and all the nuances in between. It's the go-to choice for companies that require a powerful tool to handle complex billing scenarios, allowing you to build a comprehensive billing system from scratch with ease.

For further information and detailed comparisons:

👉 Stripe Billing vs. Lago comparison: here

👉 Chargebee vs. Lago comparison: here

TL;DR: Table of comparison Stripe Billing vs. Chargebee

- Performance: $599/month, includes $100k monthly billing, then 0.75% on revenue

- Enterprise: Custom pricing

Concurrent requests at a time: 150

Focus on building, not billing

Whether you choose premium or host the open-source version, you'll never worry about billing again.

Lago Premium

The optimal solution for teams with control and flexibility.

Lago Open Source

The optimal solution for small projects.